krdcnti.ru Learn

Learn

Best Phone Spy App For Android

CHYLDMONITOR is widely regarded as one of the best Android spy apps due to its extensive features and ease of use. · ONEMONITAR is known for its. FlexiSPY's Mobile Spy App is software that lets you secretly see what your loved one or employee is doing on their phone while you're not there. Spapp Monitoring is the most advanced tracking app for Android. Spapp Monitoring records all phone calls, SMS, GPS coordinates, Whatsapp calls or messages. Spyera is a mobile monitoring software designed for Android devices that allow users to track and monitor the activities of the target device remotely. The app. Keep your children safe both online and in the real world with our mSpy™ parental tracking app. Monitor their GPS location, see who they are texting and. Keep your loved ones safe and secure with CHYLDMONITOR app, the best Android spy app for tracking online activities. Track activities like calls. ONEMONITAR is called the best Android spy app because it also monitors shared multimedia files like images, videos, audio, GIFs, etc. with the WhatsApp account. Phone spy lets you see texts, photos, calls, website history, GPS & more. Compatible with Android, iOS, PC and Mac. FlexiSPY is an advanced hidden app that allows you to secretly monitor an Android phone. It tracks calls, texts, and social media, and even. CHYLDMONITOR is widely regarded as one of the best Android spy apps due to its extensive features and ease of use. · ONEMONITAR is known for its. FlexiSPY's Mobile Spy App is software that lets you secretly see what your loved one or employee is doing on their phone while you're not there. Spapp Monitoring is the most advanced tracking app for Android. Spapp Monitoring records all phone calls, SMS, GPS coordinates, Whatsapp calls or messages. Spyera is a mobile monitoring software designed for Android devices that allow users to track and monitor the activities of the target device remotely. The app. Keep your children safe both online and in the real world with our mSpy™ parental tracking app. Monitor their GPS location, see who they are texting and. Keep your loved ones safe and secure with CHYLDMONITOR app, the best Android spy app for tracking online activities. Track activities like calls. ONEMONITAR is called the best Android spy app because it also monitors shared multimedia files like images, videos, audio, GIFs, etc. with the WhatsApp account. Phone spy lets you see texts, photos, calls, website history, GPS & more. Compatible with Android, iOS, PC and Mac. FlexiSPY is an advanced hidden app that allows you to secretly monitor an Android phone. It tracks calls, texts, and social media, and even.

“Personally, I have used other tools before like Mobile spy but I have to say FlexiSPY is the best among all these. The customer service is very efficient and. Why Choose mSpy? We could go on and on with reasons why mSpy is the best monitoring app on the planet. But we'd rather let the numbers do. It is the master spy app for mobile phones known for the advanced yet affordable mobile spy features. Spyzie is a complete app to track and manage Android and. Another form of spyware is 'stalkerware', which involves someone you know installing a spying app on your device without your permission or knowledge. These. Qustodio is the top spy app with a free trial in Its blend of features, from web filtering to call monitoring, ensures parents have all the tools they. WTMP - Find who spying on me security for android, Who touched my phone find my phone Intruder selfie app lock for android mobile, the best nosy trap app. In this blog post, we will discuss the five best spy tracking apps available on the market today that can help you understand even how to catch a cheater on. mSpy is more than an app. It's the key to the Internet. And it's yours to help you unlock their digital world, find out the truth, and rest a little easier. 10 Best Spy Apps You Should Use A spy app can be used for a variety of valid objectives. These apps can be used to locate a stolen or. eyeZy is a popular cell phone spying app that will serve you well, regardless of whether you are spying on an Android or an iOS device. It is one of those rare. Mobile Phone Tracker - hidden tracking app that secretly records location, SMS, call audio, WhatsApp, Facebook, Viber, camera, internet activity. The Phone Tracker App by Snoopza is the best tracking app for cell phones. You can track mobile locations for free, as well as track calls, chats and text. Cocospy is a reliable and effective monitoring solution for both Android and iOS devices. Features: GPS Tracking: Real-time location updates. Track an android mobile phone with just few steps by the help of cell phone tracking app Onespy. It is a phone spy app which spy apps of an. This article explores popular spy apps, providing detailed insights into their features, benefits, and drawbacks to help you make an informed decision. A new Android spyware named RatMilad was discovered targeting mobile devices in the Middle East, used to spy on victims and steal data. Researchers warned that. 1. ONEMONITAR · 2. CHYLDMONITAR · 3. uMobix · 4. EyeZy · 5. Cocospy · 6. Spyic · 7. Hoverwatch · 8. XNSPY. Why iKeyMonitor Is the Best Spy App for Mobile Phones · Remote Phone Spy. iKeyMonitor is one of the best phone spy apps with many features for remote monitoring. Best Phone Spy Apps for iPhone and Android. mSpy · Eyezy · Spynger · Phonsee · Scanerro · Searqle · Umobix. Free cell phone spy app is the best invisible software for Android mobiles that secretly tracks calls, spy camera, WhatsApp, Facebook, Viber, SMS.

Married Tax Deduction

In most cases, you will get a bigger refund or a lower tax bill if you file jointly with your spouse. There are a few situations in which filing separately can. Missouri Standard Deduction · Single - $13, · Married Filing Combined - $27, · Married Filing Separate - $13, · Head of Household - $20, · Qualified. This calculator lets you create specific situations to see how much federal income tax two people might pay if they were to marry. It compares the taxes a. For spouses filing as married filing separately with a joint obligation for home mortgage interest and real estate taxes, the deduction for these items is. Tax Year Individual Standard Deductions Amounts · Single/Head of Household/Qualifying Surviving Spouse - $5, · Married Filing Jointly - $7, · Married. The standard deduction is adjusted for inflation annually, and it is $24, for married filers in Filers may instead claim itemized deductions for. Under current law, the marriage penalty is partly alleviated because the lower income tax brackets (10%, 12%, 22%, 24%, and 32%) and the standard deduction for. $40, for a married filing joint return; These amounts may have additional limitations for retirement and pension beneficiaries using the Tier Structure. deductions for the following tax year. Below are the inflation-adjusted standard deduction amounts by year dating back to Married Individuals Filing. In most cases, you will get a bigger refund or a lower tax bill if you file jointly with your spouse. There are a few situations in which filing separately can. Missouri Standard Deduction · Single - $13, · Married Filing Combined - $27, · Married Filing Separate - $13, · Head of Household - $20, · Qualified. This calculator lets you create specific situations to see how much federal income tax two people might pay if they were to marry. It compares the taxes a. For spouses filing as married filing separately with a joint obligation for home mortgage interest and real estate taxes, the deduction for these items is. Tax Year Individual Standard Deductions Amounts · Single/Head of Household/Qualifying Surviving Spouse - $5, · Married Filing Jointly - $7, · Married. The standard deduction is adjusted for inflation annually, and it is $24, for married filers in Filers may instead claim itemized deductions for. Under current law, the marriage penalty is partly alleviated because the lower income tax brackets (10%, 12%, 22%, 24%, and 32%) and the standard deduction for. $40, for a married filing joint return; These amounts may have additional limitations for retirement and pension beneficiaries using the Tier Structure. deductions for the following tax year. Below are the inflation-adjusted standard deduction amounts by year dating back to Married Individuals Filing.

High Deductible Health Plans Different thresholds apply for dependents, people 65 and older, and those who use other tax filing statuses (like married filing. When would I want Married Filing Separately vs. Married Filing Jointly filing status? · When filing separately, one spouse can't itemize their deductions while. The standard deduction is increased to $27, for married individuals filing a joint return; $20, for head-of-household filers; and $13, for all. Married couples who file a joint Form may be eligible for an adjustment of up to $ against their joint income tax liability if each spouse received. The standard deduction for a single person or a person filing as Married Filing Separately is the same. It is $12, for tax year When two individuals. For tax year , the standard deduction is $13, for married couples filing separately. Filing separately might also exclude you from eligibility for. Standard Deduction · Deduction Amount · Married Filing Jointly, $27, Head of Household ; Alternative Minimum Tax (AMT) Exemptions · Exemption Amount. Standard Deduction ; 3, Form (nonresident) - Married, spouse has no income from any source, $8, ; 4, Form (resident), N/A ; 4, Form PY (part-year. If you are married filing jointly and you OR your spouse is 65 or older, your standard deduction increases by $1, If BOTH you and your spouse are 65 or. Married filing jointly is a tax filing status that allows a married couple to file a single tax return that records both of their taxable income, deductions. Married filing jointly means that you'll combine your income, deductions, and credits with your spouse's, all on 1 tax return with the same tax rate. When you. married couple filing jointly when both taxpayers have They'll ask questions to figure things like the total income, tax deductions, and credits. Residential Homeowner's Property Tax Deduction. Details. You may be able to deduct up to $2, ($1, if married filing separately) of the Indiana property. If you filed a joint federal income tax return, but your Virginia filing status is married, filing separately, you'll need to divide your deductions between. A couple incurs a marriage penalty if a couple pays more income tax filing as a married couple than the two of them would pay if they were single and filed as. For Married Filing Joint or Combined returns, the $4, standard deduction amount or the itemized deduction amount may be divided between the spouses in any. Your standard deduction is based on your filing status. Standard Deduction for Federal Income Tax. Filing Status, Standard Deduction. Married Filing Joint. tax credit can I also deduct it from household income? No, you may not, since it was not included on your Federal as a deduction from income you may. $ 27, for a married couple filing a joint return; and; $ 20, for individuals filing a head of household return. Change to Standard Deduction Increase for.

Hulu Through Verizon

If you have an eligible Verizon plan, you may be able to sign up for Disney+ or the Disney Bundle (includes Disney+ (No Ads), Hulu (With Ads), and ESPN+ (With. Now Disney+, Hulu, and ESPN+ are available through Verizon. When I sign up for the Disney Bundle on us promotional subscription, how do I set up my Hulu account? · Tap Activate Hulu (With Ads) during the Disney Bundle. Verizon. You can confirm your billing party on your Hulu Account page in the Keep in mind that viewers who pay for Hulu through a third party may need to. To sign up for Hulu as a Verizon-billed subscriber, you'll need to sign up for the Disney Bundle through the My Verizon App or your Verizon Account page. Bundle subscribers can stream Hulu content directly on Hulu, in addition to select content via the Disney+ app or website. Disney+: Watch all your favorite. Here's how to add the Disney Bundle, which includes Disney+, Hulu and ESPN+, via the My Verizon app. The Disney Bundle from Verizon includes Disney+ (No Ads), Hulu (With Ads), and ESPN+ (With Ads). Access content from each service separately. The Disney Bundle. Once you activate Hulu, a credit from Verizon will appear on your account, so your credit card will not be charged. The CC stays there incase. If you have an eligible Verizon plan, you may be able to sign up for Disney+ or the Disney Bundle (includes Disney+ (No Ads), Hulu (With Ads), and ESPN+ (With. Now Disney+, Hulu, and ESPN+ are available through Verizon. When I sign up for the Disney Bundle on us promotional subscription, how do I set up my Hulu account? · Tap Activate Hulu (With Ads) during the Disney Bundle. Verizon. You can confirm your billing party on your Hulu Account page in the Keep in mind that viewers who pay for Hulu through a third party may need to. To sign up for Hulu as a Verizon-billed subscriber, you'll need to sign up for the Disney Bundle through the My Verizon App or your Verizon Account page. Bundle subscribers can stream Hulu content directly on Hulu, in addition to select content via the Disney+ app or website. Disney+: Watch all your favorite. Here's how to add the Disney Bundle, which includes Disney+, Hulu and ESPN+, via the My Verizon app. The Disney Bundle from Verizon includes Disney+ (No Ads), Hulu (With Ads), and ESPN+ (With Ads). Access content from each service separately. The Disney Bundle. Once you activate Hulu, a credit from Verizon will appear on your account, so your credit card will not be charged. The CC stays there incase.

TIP: Disney+ subscribers who have access to Hulu (either through the Getting Disney+ or the Disney Bundle with Verizon. Need more help? We are. An activation link is presented during signup and sent via email, but you can also take action from your Disney+ account page. When you activate your Hulu. Verizon · Xfinity. BACK TO TOP. Still need help? If you're having trouble For those looking to sign up through a third party, we suggest reaching out to your. Hi, I'm having trouble activating my Disney+, ESPN, and Hulu bundle through my Verizon account. Every time I hit "Go to Disney", it prompts. Get Disney+, Hulu, and ESPN+ with the Disney Bundle so you can watch the best movies, shows and sports. Watch this video to learn how. When I sign up for the Disney Bundle on us promotional subscription, how do I set up my Hulu account? · Tap Activate Hulu (With Ads) during the Disney Bundle. I continue to be billed for Hulu through APPLE Subscription services. Am I ok to cancel Hulu through apple and know that it will still work through my Verizon. Next, you activate Hulu on the Disney page singing into your no ads account. This will apply the Verizon credit to the Hulu with no ads making. Offer includes Hulu (With Ads). After 12 months, consumer action is required to continue complimentary subscription. If no action is taken, subscription auto-. Beginning August 20th, Disney+, Hulu and ESPN+ will be included in select Mix & Match Unlimited wireless plans, along with features like Apple Music and the. Select Verizon customers can get the Disney Bundle with their Verizon plan, consisting of Disney+ (No Ads), Hulu (With Ads), and ESPN+ (With Ads). If you. The Disney Bundle from Verizon includes Disney+ (No Ads), Hulu (With Ads), and ESPN+ (With Ads). Access content from each service separately. If you have an eligible Verizon plan, you can sign up for the Disney Bundle through Verizon to get access to Disney+ (No Ads), ESPN+ (With Ads), and Hulu. Get Disney+ bundled with a number of streaming services like Hulu and ESPN+. Add an Unlimited Plan for fast streaming with 5G. Verizon has announced a brand new streaming bundle, where myPlan customers can get the ad-supported versions of Netflix and Max for $10 a month. Once you enroll for the Disney Bundle via your online Verizon account, you do have to log into the online Disney+ account to activate both the Hulu and ESPN. It. My questions are: does anyone stream on hulu with Verizon dataplan and how much do you use or suggest that we increase as we just want to download the Olympics. Help with the Disney+, Hulu, Max Bundle · Change your payment method Verizon Fios: Sign in to your Verizon account at My Verizon or the My Verizon app. You can get a Disney+, Hulu (the plan with ads), and ESPN+ bundle for free ($/month value) if you have at least one Get More Unlimited or Play More. With your Verizon subscription, you now get a free Hulu account. This free subscription provides you access to the entire on-demand TV episode and movie library.

Auto Loan Terminology

Loan-to-value ratio explains the relationship between the amount you borrow and the value of the car the loan uses for collateral. Terms range from months. Financing vehicle at % APY equals an estimated $ monthly payment for 48 months for a $10, loan, resulting in a %. Definitions for Common Automotive Finance Terminology · Secured Loan - A loan that is secured by collateral. · Security - Assets or personal property pledged as. The longer loan terms naturally makes your monthly payments less, so you have some flexibility in case there is a pause in your income stream. Definitions for Common Automotive Finance Terminology · Secured Loan - A loan that is secured by collateral. · Security - Assets or personal property pledged as. Auto Finance Terms · APR – Annual Percentage Rate · Assignment – A transfer of a loan from one lender to another. · Base Price – The costs of a car with standard. Auto Equity Loan Often referred to as a title loan, this type of loan uses the equity you have in your vehicle in exchange for your title. Here's a glossary of auto loan terms to help you better understand the lingo—and get the best deal possible. The first few terms define the loan itself, and you will hear others during the process of applying and signing your loan documents. Loan-to-value ratio explains the relationship between the amount you borrow and the value of the car the loan uses for collateral. Terms range from months. Financing vehicle at % APY equals an estimated $ monthly payment for 48 months for a $10, loan, resulting in a %. Definitions for Common Automotive Finance Terminology · Secured Loan - A loan that is secured by collateral. · Security - Assets or personal property pledged as. The longer loan terms naturally makes your monthly payments less, so you have some flexibility in case there is a pause in your income stream. Definitions for Common Automotive Finance Terminology · Secured Loan - A loan that is secured by collateral. · Security - Assets or personal property pledged as. Auto Finance Terms · APR – Annual Percentage Rate · Assignment – A transfer of a loan from one lender to another. · Base Price – The costs of a car with standard. Auto Equity Loan Often referred to as a title loan, this type of loan uses the equity you have in your vehicle in exchange for your title. Here's a glossary of auto loan terms to help you better understand the lingo—and get the best deal possible. The first few terms define the loan itself, and you will hear others during the process of applying and signing your loan documents.

The most common lengths of car loans may range anywhere from 36 to 84 months total, though some may be shorter or longer. Car loans typically have terms between 36 months (3 years) and 72 months (6 years). It's possible to find shorter loan terms, and longer terms are becoming more. BCU offers a wide range of loan repayment options with terms up to 75 months (up to 84 months for brand new vehicles). Auto loans key terms · Actual Cash Value (ACV) · Amortization · Annual Percentage Rate (APR) · Assignee · Base price · Buy rate · Co-signer · Credit insurance. Jump to a term: · Actual Cash Value · Amortization · Annual Percentage Rate (APR) · Co-Signer · Depreciation · Down Payment · Force-Placed Insurance. Auto Equity Loan Often referred to as a title loan, this type of loan uses the equity you have in your vehicle in exchange for your title. You must have a deposit account with Regions that has been open for at least six months in order to be eligible for an automobile loan. · As of 9/6/23, annual. Loan Payment Terminology · Installment – An agreed upon amount the borrower pays each month. · Loan Term – All the agreed upon details of the loan including how. Don't like shopping for a car? That's okay. We do! We'll help you find your next vehicle with Auto Solution car-finding services. Terms Up to 84 Months. Keep. auto loan application. Vehicle Information: Make; Model; Year; Mileage. Loan Information: Car Value; Down Payment; Loan Amount; Loan Terms (desired in months). A car loan term simply means how long you'll make payments on the loan. Auto finance terms may largely depend on how much you're borrowing. A larger loan amount. ²TERMS: Terms available up to 84 months for auto loan purchases and auto loan refinances, up to months for boat and RV loan purchases, and up to 72 months. Use this calculator to compare car loan terms. Change the numbers in each input field by entering a new number or adjusting the sliders. These loans are secured by collateral on the vehicle, and the owner can't transfer the title without paying off or satisfying the loan terms. If the vehicle. Calculate your auto loan payment and determine which type of financing term suits your budget with the Auto Loan Term Calculator from Fifth Third Bank. credit card payment, student loan, mortgage, and auto loan), is divided by the gross monthly income. The maximum allowable overall ratio for MOP loans is 48%. The average auto loan term for new vehicles is months, or less than six years, according to Experian. Used car loans, despite being significantly smaller. With competitive interest rates, terms and helpful online tools, SnoCope auto loans makes it simple to get behind the wheel. Learn more today. The term for your auto loan is the period during which your loan agreement is in place. Before the end of your loan term, your loan should be repaid, with. How Auto Loan Rates Work · Credit Score: Lenders use your credit score to assess your creditworthiness. · Loan Term: Shorter loan terms usually.

Best Home Insurance Companies Nyc

We work with top-rated high net worth insurers, including PURE, Chubb, AIG, Cincinnati Insurance, NatGen Premier and Vault Custom, to provide you with the. The special discounts available through Farmers Insurance Choice are not available to the general public.**** *Ratings are based on A.M. Best Company's. Per Bankrate's proprietary research method, Allstate, State Farm, Nationwide and NYCM offer the best homeowners insurance in New York. Average homeowners insurance in NY. The average price of home insurance in New York varies depending on where you live. The following is the average annual cost. More homeowners choose State Farm® as their home insurance company over any other insurer. 1Return to reference State Farm Is the largest homeowners insurer. NYCM Insurance: Home & Car Insurance Company in New York · NYCM Insurance Blog. Read our blog to get answers to your insurance questions and learn how to save. If you've got a high value home, you're going to want to go with a company like Chubb, which offers best in class service and coverage. PURE and. Where you live can change what your homeowners insurance covers. See what's covered in New York and talk to an agent to learn more. When you choose Mercury, you get one of the best homeowners insurance companies What Types of Insurance Are Available in NY from Mercury? Explore the. We work with top-rated high net worth insurers, including PURE, Chubb, AIG, Cincinnati Insurance, NatGen Premier and Vault Custom, to provide you with the. The special discounts available through Farmers Insurance Choice are not available to the general public.**** *Ratings are based on A.M. Best Company's. Per Bankrate's proprietary research method, Allstate, State Farm, Nationwide and NYCM offer the best homeowners insurance in New York. Average homeowners insurance in NY. The average price of home insurance in New York varies depending on where you live. The following is the average annual cost. More homeowners choose State Farm® as their home insurance company over any other insurer. 1Return to reference State Farm Is the largest homeowners insurer. NYCM Insurance: Home & Car Insurance Company in New York · NYCM Insurance Blog. Read our blog to get answers to your insurance questions and learn how to save. If you've got a high value home, you're going to want to go with a company like Chubb, which offers best in class service and coverage. PURE and. Where you live can change what your homeowners insurance covers. See what's covered in New York and talk to an agent to learn more. When you choose Mercury, you get one of the best homeowners insurance companies What Types of Insurance Are Available in NY from Mercury? Explore the.

If someone is injured on your property, or anyone on your policy causes damage to someone else's property or stuff, your insurance company should have you. Progressive can help you find personalized coverage at an affordable price. Find out everything you need to about homeowners insurance in New York, including. AM Best is the largest credit rating agency in the world specializing in the insurance industry. AM Best does business in over countries. The Utica First Insurance Company located in Oriskany, NY is a regional property and casualty insurance carrier. State Farm: Best home insurance in New York. · Nationwide: Best home insurance for high-value houses. · Travelers: Great home insurance for customer satisfaction. Why choose Liberty Mutual for homeowners insurance? Rated "A" (Excellent) financial by A.M. Best Company, we've been helping people like you protect what they. It is up to you to purchase the policy that best meets your needs. When Some homeowners insurance companies offer an endorsement that provides. We've got you covered. And then some. · Homeowners Insurance · Car Insurance · Boat Insurance · Motorcycle Insurance · RV Insurance · Flood Insurance. Compare The Best Condo Insurance Companies In New York ; Travelers. Discounts. A. ; Chubb. High-Value Condos. A++. homeowners insurance in NY To get the best price, you'll want to shop around for quotes from homeowners insurance companies in New York and around the country. A company can only 'non renew' you every 3 years in NY, so if your Can someone advice on best home insurance? 5 comments. r. Get a free New York homeowners insurance quote today. Nationwide offers a variety of home insurance coverage options to protect your home and property. Condo insurance is similar to homeowners insurance except for one key difference. If you are (or will soon be) a new condo owner, you may be in the market for. Average homeowners insurance in NY. The average price of home insurance in New York varies depending on where you live. The following is the average annual cost. Find cheap New York home insurance quotes from Ocean Harbor Casualty, Kingstone Insurance Company, State Farm, and more. Yearly rates start at $ In order to give you an idea of the differences among policies, set forth below is a comparison of the coverage typically offered under standard policies. Basic. As the premier Condo, Co-op, and Apartment Insurance provider in NYC, Gotham Brokerage Co specializes in finding customized solutions to meet our clients'. Best High Net Worth Insurance Company. Private Asset Management Awards: Average annual savings on homeowners insurance for members nationwide. Average Coverages in a $, New York Homeowners Insurance Policy Your other structures coverage is typically 10% of your dwelling coverage. You can change.

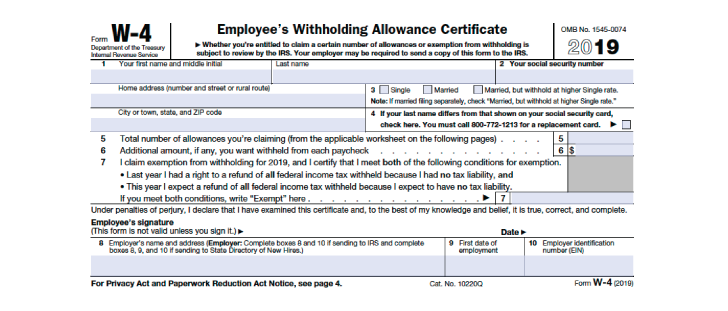

How To Do My W4

Step 1: Enter your personal information · Step 2: Multiple jobs or spouse works · Step 3: Claim dependents (if applicable) · Step 4: Make other adjustments . The IRS has issued a new Form W-4 that does not allow for exemptions when calculating employee withholding. Because Delaware still allows taxpayers to take. You can download and print a Form W-4, order multiple copies, or call TAX-FORM (). You may also use a substitute Form W-4 you developed instead. Download Form W-4 V: Voluntary Withholding Request from the IRS' website. Then, find the Social Security office closest to your home and fax or mail us the. Current employees with a valid W-4 on file are not required to complete a new form simply due to the redesign, but employers should make their teams aware of. E-File My Taxes · Find Exemptions | Credits · Understand Why I Got a Letter If you need to update the individual responsible for filing the sales and use and. Enter your new tax withholding amount on Form W-4, Employee's Withholding Certificate; Ask your employer if they use an automated system to submit Form W If you don't withhold enough taxes, you may have a larger federal tax bill once you file your return. “Should I re-check my W-4 after I get married?” It's best. If you do not file a completed Form. IL-W-4 with your employer, if you fail to sign the form or to include all necessary information, or if you alter the form. Step 1: Enter your personal information · Step 2: Multiple jobs or spouse works · Step 3: Claim dependents (if applicable) · Step 4: Make other adjustments . The IRS has issued a new Form W-4 that does not allow for exemptions when calculating employee withholding. Because Delaware still allows taxpayers to take. You can download and print a Form W-4, order multiple copies, or call TAX-FORM (). You may also use a substitute Form W-4 you developed instead. Download Form W-4 V: Voluntary Withholding Request from the IRS' website. Then, find the Social Security office closest to your home and fax or mail us the. Current employees with a valid W-4 on file are not required to complete a new form simply due to the redesign, but employers should make their teams aware of. E-File My Taxes · Find Exemptions | Credits · Understand Why I Got a Letter If you need to update the individual responsible for filing the sales and use and. Enter your new tax withholding amount on Form W-4, Employee's Withholding Certificate; Ask your employer if they use an automated system to submit Form W If you don't withhold enough taxes, you may have a larger federal tax bill once you file your return. “Should I re-check my W-4 after I get married?” It's best. If you do not file a completed Form. IL-W-4 with your employer, if you fail to sign the form or to include all necessary information, or if you alter the form.

Will my tax withholdings change with this new form even if my situation doesn't? One of the goals of the form was to make withholdings more accurate. Changes to information submitted are "real time" updates and are immediately reflected in Banner/Payroll. You can view your change in the W-4 Form in My UI Info. The W-2 is used specifically to deduct income taxes from your paycheck for federal purposes - there are other deductions you can make, state tax withholding. Information. When you start working you will need to fill out a form to set the amount of taxes that will be taken out of your check each payday. This form is. Step-by-Step Gide to Filling Out a W · Step 1: Provide Your Information · Step 2: Indicate Multiple Jobs or a Working Spouse · Step 3: Add Dependents · Step 4. Answers others found helpful. What is an Illinois withholding exemption? I am an employer. Am I required to submit copies of my employees' W How to calculate your. W-4 · 1. Gather documentation (paystubs, previous tax return, invoices, etc.) · 2. Follow the prompts to fill out the withholding. NOTE: if you claim EXEMPT you must complete a new W-4 annually in February. Page 2. Common errors that will make a W-4 invalid: An incomplete or inaccurate W. How Do I Register to Vote · Renew My License Plate · View assistance programs. Unsupported Browser Detected. The web Browser you are currently using is. How Do I Update My W-4 Information? Log in to OneUSG Connect. Navigation: Employee Self Service > Payroll > Taxes > W-4 Tax Information. Page 2. 3. Select W Do the same on Form W-4 for the other job. This option is generally more Under penalties of perjury, I declare that this certificate, to the best of my. How do I get a copy of my W-4 form? To receive a copy of your W-4 form, just reach out to your human resources or payroll department. It's always a good idea to. If you are a Federal Work Study student employee, please note this does not automatically make you exempt from taxes. The top of the W-4 does state: This. How do I complete or update my W-4? Please remember that TSS cannot give you tax advice or tell you how to complete your W Please consider speaking to a tax. The Form OR-W-4 Instructions contain three worksheets that you can use to figure out your withholding. Worksheet A is used for figuring out your personal. allowances. • Claiming zero allowances means less take home pay, but a bigger tax refund during tax season. Update Form W Update Form W-4 Navigation: My Self Service > Payroll and Compensation > W-4 Tax Information. Exemption from Withholding. If an employee. Federal Form W-4 is used to help employers collect information needed to take out the proper amount of federal income taxes from employees' paychecks. do not complete a W-4 for Iowa. A fee will be charged for each tax year requested. View Withholding Frequently Asked Questions. Secondary Navigation Menu. Where can I find my unemployment number? If the employee decides to submit only a new IRS form W-4, do not include any additional Colorado withholding.

Top Lithium Stocks To Invest In

Below is a list of the top lithium mining stocks based on their exploration potential and an explosion in demand for lithium. Lithium Stocks ; SNNAF SIENNA RESOURCES · ; ALB ALBEMARLE · ; SGML SIGMA LITHIUM · ; LAC LITHIUM AMERICAS · ; PMETF PATRIOT BATTERY METALS · If you're bullish on lithium for the long term, consider looking into established lithium producers like Albemarle Corporation (ALB), Sociedad. This article will discuss different ways to invest in Lithium and why you should be bullish or bearish on the industry for the future. Hydrogen stocks vs. lithium stocks: which is the better investment? 14th Oct There's been a lot of investor activity recently in the green/alternative. TOP 5 ASX LITHIUM STOCKS - SHARES IN VALUE. MINERAL RESOURCES DLI is a unique investment proposition given the double engine of production and expansion. In this guide, we will provide insights into the broader lithium industry, and examine the positive aspects of investing in lithium shares today. The Best ASX Lithium Stocks to buy Now In September · Mineral Resources (ASX:MIN). Mineral Resources is a standout choice for investors, especially given. Invest in EnergyX stock alongside General Motors, POSCO, and + everyday investors. The investment opportunity ends Oct. 3. Below is a list of the top lithium mining stocks based on their exploration potential and an explosion in demand for lithium. Lithium Stocks ; SNNAF SIENNA RESOURCES · ; ALB ALBEMARLE · ; SGML SIGMA LITHIUM · ; LAC LITHIUM AMERICAS · ; PMETF PATRIOT BATTERY METALS · If you're bullish on lithium for the long term, consider looking into established lithium producers like Albemarle Corporation (ALB), Sociedad. This article will discuss different ways to invest in Lithium and why you should be bullish or bearish on the industry for the future. Hydrogen stocks vs. lithium stocks: which is the better investment? 14th Oct There's been a lot of investor activity recently in the green/alternative. TOP 5 ASX LITHIUM STOCKS - SHARES IN VALUE. MINERAL RESOURCES DLI is a unique investment proposition given the double engine of production and expansion. In this guide, we will provide insights into the broader lithium industry, and examine the positive aspects of investing in lithium shares today. The Best ASX Lithium Stocks to buy Now In September · Mineral Resources (ASX:MIN). Mineral Resources is a standout choice for investors, especially given. Invest in EnergyX stock alongside General Motors, POSCO, and + everyday investors. The investment opportunity ends Oct. 3.

I think lithium can be a nice long term play for me. Would you suggest investing in a lithium mining company? If so, what companies do you like? iShares Lithium Miners and Producers UCITS ETF (LITM); WisdomTree Battery Solutions UCITS ETF (VOLT); Global X ETFs ICAV Lithium & Battery Tech UCITS ETF (LITG). Our innovative battery cell technology can store energy more efficiently and reliably than today's lithium-ion batteries. of Capital Investment. Invest in these three best battery stocks, likely to benefit from a global shift in energy storage demands and lithium market corrections. Global X Lithium & Battery Tech ETF ; Albemarle, % ; Ganfeng Lithium, % ; Yunnan Energy, % ; Naura Technology Group, % ; Contemporary Amperex, %. Deep Learning, Decision-Making System Developer · Analysis of Top 5 ASX Lithium Stocks of · 1. Solis Minerals (ASX:SLM) · 2. Latin Resources. American Lithium started at buy with $5 stock price target at B. Riley. Mar. 1, at a.m. ET by Tomi Kilgore ; GM investment powers Lithium Americas on. Within the Lithium Mining sector, the top gainer was GMDC (up %). On the other hand, AMARA RAJA ENERGY & MOBILITY (down %) and HINDUSTAN ZINC (down %). Top Dividend Stocks To Invest In September ? 2 To Watch. Dividend stocks to watch in the stock market right now. ; 2 Cybersecurity Stocks To Watch In. companies involved in the mining and production of lithium and lithium to recognize the “best of the best” among Canadian investment funds. The. Lithium Dividend Stocks, ETFs, Funds ; BHP Group Limited - ADRBHP Group Limited ADR. BHP · $ %. $ B ; Sociedad Quimica Y Minera de Chile S.A. -. Investing in lithium is becoming increasingly popular. Read on to learn about the rise of lithium stocks and ETFs, and how you can trade on the CFD trading. Top producers (countries) of lithium · Australia is the largest producer of lithium, accounting for around 48% of the world's production. · Chile is the second-. Analyst Ratings ; American Lithium Corp. stock logo. AMLI. American Lithium. Strong Buy ; Atlas Lithium Co. stock logo. ATLX. Atlas Lithium. Buy. Uncover the top ASX Lithium stocks from our expert mining analysts who recommends the best under-valued mining shares! American behemoth Albemarle is the world's top lithium producer, with one of its two business units exclusively focused on the lithium-ion battery and energy. A downward trend in lithium prices could be reversing. When looking for the best stocks to invest in lithium, it's essential to consider companies with a strategic focus on lithium exploration and. Other ways to invest in lithium companies · Global X Lithium & Battery ETF (LIT): This ETF follows the Solactive Global Lithium Index and its top three holdings. Hydrogen stocks vs. lithium stocks: which is the better investment? 14th Oct There's been a lot of investor activity recently in the green/alternative.

Superslots No Deposit Bonus

Super slots casino no deposit bonus codes for free spins this is only happening when you choose the third card and the value of your hand will be 22 or. Players can claim the SS bonus code on their 2nd to 6th deposits only. The maximum bonus amount per deposit is $1, Players can claim the SS bonus code on their 2nd to 6th deposits only. The maximum bonus amount per deposit is $1, dollar free no deposit casino bonus is one of the best NDB offers for beginners. It allows them to sign up and play games for zero fees. For example, making. Super slots casino no deposit bonus codes for free spins this is only happening when you choose the third card and the value of your hand will be 22 or. You can enjoy the convenience of faster deposits, simple withdrawals, and bigger bonuses with our crypto slots. You can choose to use Bitcoin (BTC), Bitcoin SV. The bonus will be available in the account. Minimum deposit requirements: $ This offer is For depositing only. Please note, it can take up to 24 hours. Play online casino games at the leading online casino - krdcnti.ru Whether you are looking for slots, table games, video poker or live dealer. A no deposit free spins bonus is usually given as bonus spins on select online slot games, like 50 free spins on Play'n GO's Book of Dead. Note that free spins. Super slots casino no deposit bonus codes for free spins this is only happening when you choose the third card and the value of your hand will be 22 or. Players can claim the SS bonus code on their 2nd to 6th deposits only. The maximum bonus amount per deposit is $1, Players can claim the SS bonus code on their 2nd to 6th deposits only. The maximum bonus amount per deposit is $1, dollar free no deposit casino bonus is one of the best NDB offers for beginners. It allows them to sign up and play games for zero fees. For example, making. Super slots casino no deposit bonus codes for free spins this is only happening when you choose the third card and the value of your hand will be 22 or. You can enjoy the convenience of faster deposits, simple withdrawals, and bigger bonuses with our crypto slots. You can choose to use Bitcoin (BTC), Bitcoin SV. The bonus will be available in the account. Minimum deposit requirements: $ This offer is For depositing only. Please note, it can take up to 24 hours. Play online casino games at the leading online casino - krdcnti.ru Whether you are looking for slots, table games, video poker or live dealer. A no deposit free spins bonus is usually given as bonus spins on select online slot games, like 50 free spins on Play'n GO's Book of Dead. Note that free spins.

krdcnti.ru - Online Casino Bonus Blog | New Online Casino Bonus Codes Updated Daily! Casino No Deposit Bonus Codes, Casino Free Spins Codes - (). Super Slots – Top Bitcoin Online Casino for Free Spins Promos. superslots casino Yes, some of the best bitcoin casino sites offer no deposit bonuses or free. Unlock the latest Super Slots no deposit bonus codes to spin and win without risking a penny. Get instant access to exclusive slot bonuses. Looking for Super 6 slot free spins no deposit bonus ? Read our review and get $31 Free no deposit bonus for real money play. Looking for Super 6 slot free spins no deposit bonus ? Read our review and get $31 Free no deposit bonus for real money play. Super Slots Casino Bonus Codes | Best Super Slots Casino Bonuses, Super Slots Casino No Deposit Bonus Codes, Super Slots Casino Free Spins - (). All sites will offer a sweepstakes casino no deposit bonus which will give players the chance to try out multiple games before they may want to purchase a coin. This scenario is ideal for first-time users to get an idea of how online casinos work. Armed with no deposit bonus codes or other offers, players can get. If you claim a $ free chip, you will receive $ in bonus credits to play at an online casino. No deposit is required and you do not have to share any. No deposit slot bonuses are a type of casino promotion that includes a reward (free cash, free credits or free spins) and doesn't require the player to make a. Promotions · $6, WELCOME BONUS · 10% BITCOIN BOOST · SEPTEMBER RELOADS SPECIAL · HOLD & WIN WEEKENDER · FOOTBALL SLOTS RAFFLE · WEEKLY LEADERBOARD · $35, IN. A $ no deposit bonus code is exactly what it claims to be. You get a code from our site, you enter it into a casino's 'cashier' section, and you receive $ All no deposit bonuses have a maximum cashout limit, which may range from as little as $20 to a hefty $, however, the most frequently seen amount is $ Claim our no deposit bonuses and you can start playing at casinos without risking your own money. Sign up, claim, and enjoy – easy. View Bonuses · Show Ball 3. Enjoy all the hottest deposit bonus deals, Everygame Casino no deposit bonus At Everygame Red you'll find game types of super slots, top table games. Free Welcome Bonus No Deposit Required ; The 7Bit Casino logo. 7Bit Casino · Get $5 No Deposit Bonus from 7Bit Casino ; The krdcnti.ru Casino logo. krdcnti.ru A no deposit welcome bonus is offered to new players simply in exchange for signing up and joining a new online casino. Other names for these bonuses include no. Super Slots Casino Bonus Codes | Find the Best Super Slots Casino Coupons on krdcnti.ru! Exclusive No Deposit Bonuses, Free Spins, and more! A no deposit welcome bonus is offered to new players simply in exchange for signing up and joining a new online casino. Other names for these bonuses include no. SlotOCash – Up to 35% Instant Weekly Cashback with No Max Cap. BetNow – Fast and Secure Crypto Deposits with a $10 Minimum Limit. Super Slots – One of the Best.

How To Buy Stock When It Reaches A Certain Price

Stop Order. This is an order to buy or sell a security once the price of the security reaches a specified price, known as the "stop price." When. A limit order allows investors to buy or sell securities at a price they set or better stock reaches the limit price), or they can set an expiration date. A buy limit order is an order to purchase an asset at or below a specified price, allowing traders to control how much they pay. Market order is a buy or sell order in a stock market where investors only mention the quantity they want to buy or sell and the price is decided according to. Limit orders are filled only if the stock's market price reaches the limit price you entered within the time frame specified in your duration. While limit. If your price cannot be met, your order will be cancelled ('killed'). Enter your chosen price next to Limit Price. Unlike limit orders, you cannot set a time. A limit order is an order to either buy stock at a designated maximum price per share or sell stock at a minimum price share. When the stock hits a stop price that you set, it triggers a limit order. Then, the limit order is executed at your limit price or better. Investors often use. A limit order ensures that you get a price for a stock or an ETF in the range you set—the maximum you're willing to pay or the minimum you're willing to accept. Stop Order. This is an order to buy or sell a security once the price of the security reaches a specified price, known as the "stop price." When. A limit order allows investors to buy or sell securities at a price they set or better stock reaches the limit price), or they can set an expiration date. A buy limit order is an order to purchase an asset at or below a specified price, allowing traders to control how much they pay. Market order is a buy or sell order in a stock market where investors only mention the quantity they want to buy or sell and the price is decided according to. Limit orders are filled only if the stock's market price reaches the limit price you entered within the time frame specified in your duration. While limit. If your price cannot be met, your order will be cancelled ('killed'). Enter your chosen price next to Limit Price. Unlike limit orders, you cannot set a time. A limit order is an order to either buy stock at a designated maximum price per share or sell stock at a minimum price share. When the stock hits a stop price that you set, it triggers a limit order. Then, the limit order is executed at your limit price or better. Investors often use. A limit order ensures that you get a price for a stock or an ETF in the range you set—the maximum you're willing to pay or the minimum you're willing to accept.

When the market price of the stock reaches or exceeds this level that is predetermined by the investor, the stop-limit order is initiated. Subscribe to. This ensures that the buy price does not exceed the specified level, offering a safeguard against further price escalation. Similarly, when a sell limit order. A limit order allows you to buy or sell a stock at a set price in the future. Only when the stock reaches the set price, or better, will the order be completed. You can set a GTC limit order to buy eight shares of Apple at $ apiece, or $1, in total. If Apple's stock reaches that desired price within two months. Stop Order. This is an order to buy or sell a security once the price of the security reaches a specified price, known as the "stop price." When this stop. A limit order lets you set the purchase or sell price for a security. The trade is executed only if the market price reaches or is better than the set limit. Stop-limit orders allow you to automatically place a limit order to buy or sell when an asset's price reaches a specified value, known as the stop price. This. A broker who is buying stock places a "bid" on your behalf which represents the maximum price that you will pay right now for a certain number. A Limit Order (buying). An order to buy a stock with a maximum price to be paid. The 'limit price' is set below the current market price and the. touches your specified price The price where you actually buy or sell a stock is the execution or the fill price. A stop-limit order triggers a limit order once the stock trades at or through your specified price (stop price). Your stop price triggers the order; the limit. A type of order used to buy or sell securities when the market price reaches a specified value, known as the stop price. Stop orders are generally used to. When you place a limit order to buy, the stock is eligible to be purchased at or below your limit price, but never above it. You may place limit orders either. Stop: You can sell a security such as a stock if its price falls past a specified point, used to limit (i.e. “stop”) losses or lock in profits. (Buy stop orders. In other words, if you want to buy 50 shares of a stock when the price reaches $50, then you may have a buy-stop order that specifies the purchase of 50 shares. Stop-limit orders allow you to set a stop price and a limit price for a given security. Once a security reaches your stop price, the order is automatically. A stop-loss order is an instruction to buy or sell a stock when it reaches a certain price. A stop-loss order triggers a market order when a designated price is. A Limit order is an order to buy or sell at a specified price or better. The Limit order ensures that if the order fills, it will not fill at a price less. You can set a limit order for $55 that will activate as soon as the stock reaches this price, assuming your broker is able to find a buyer for your stock. A limit order is an order to buy or sell shares that is executed when the stock price reaches a certain price level. Limit orders will only fill at the price.

Stein Roe Young Investor Fund

Stein Roe unit was one of the first mutual funds to target youngins Rowe offers strength in stocks and bonds. It manages 77 funds, 31 of which. fund, Stein Roe's Young Investor Fund. I cashed that fund out ages ago for a steep loss, percentage-wise. One of the hundred-plus electronic. Do you own any mutual funds? O Yes. No. O Not Sure. F3. Are you a Stein Roe Young Investor Fund shareholder? O Yes. O No. Not Sure. G. Knowledge Questions. G1. YOUNG f J, CO!\lEW YORk N 'I'. YOUNG SMITH" PEACOCk llilt. 'HOENII. ARII Stein Roe & Farnham Stock Fund, Inc. Studley, Shupert & Co. Inc. of Boston. financial services division of Arthur Andersen and as the chief finan- cial and administrative officer of Stein Roe & Farnham, a registered investment adviser. For example, the Stein Roe Young Investor Fund accepts investments as low as money for stocks, mutual funds, and other investments). Discuss. Stein Roe Young Investor Fund, intended to teach children about investing while helping them save for college and other long-term goals. Have a confidential. fund that caters to children such as the Stein Roe Young Investor fund. Many funds accept regular monthly investments as low as $50 a month, so these funds. int-sized investors who are stashing their birthday money with Stein Roe's Young Investor fund can learn a lot about its manager's favorite picks, such as. Stein Roe unit was one of the first mutual funds to target youngins Rowe offers strength in stocks and bonds. It manages 77 funds, 31 of which. fund, Stein Roe's Young Investor Fund. I cashed that fund out ages ago for a steep loss, percentage-wise. One of the hundred-plus electronic. Do you own any mutual funds? O Yes. No. O Not Sure. F3. Are you a Stein Roe Young Investor Fund shareholder? O Yes. O No. Not Sure. G. Knowledge Questions. G1. YOUNG f J, CO!\lEW YORk N 'I'. YOUNG SMITH" PEACOCk llilt. 'HOENII. ARII Stein Roe & Farnham Stock Fund, Inc. Studley, Shupert & Co. Inc. of Boston. financial services division of Arthur Andersen and as the chief finan- cial and administrative officer of Stein Roe & Farnham, a registered investment adviser. For example, the Stein Roe Young Investor Fund accepts investments as low as money for stocks, mutual funds, and other investments). Discuss. Stein Roe Young Investor Fund, intended to teach children about investing while helping them save for college and other long-term goals. Have a confidential. fund that caters to children such as the Stein Roe Young Investor fund. Many funds accept regular monthly investments as low as $50 a month, so these funds. int-sized investors who are stashing their birthday money with Stein Roe's Young Investor fund can learn a lot about its manager's favorite picks, such as.

funds were premature: No-load fund firm Stein Roe & Farnham Inc. is offering load shares of its highly rated Young Investor Fund, which until now has been. The popularity of stock-picking contests and high school investment clubs—along with successful marketing vehicles, such as Stein Roe's Young Investors Fund. An Interview With David Brady, Portfolio Manager, Stein Roe Young Investor Fund Mutual Funds Workshop: How many funds do you need in your investment portfolio. Segall was a senior vice president of Stein Roe & Farnham, managing a variety of accounts including a mutual fund. Single-State Investment Risk: A fund that. Gimmicky? Maybe. Effective? Definitely. The Stein Roe Young Investor Fund, conceived in part to help educate kids and other neophytes about investing in the. It doesn't hurt that the Stein Roe Young Investor Fund boasts an average annual return of % from March to March , and will accept initial. Stein Roe's new Large Cap fund, and co-manager of Stein Roe Young Investors Fund. "But in a flat market, or a down year, it's going to make a big difference. STEIN ROE'S YOUNG INVESTORS 6TH ANNUAL ESSAY CONTEST. A Kids Investment Contest Parents Can Learn From. Helping kids become savers and then investors is. Segall was a senior vice president of Stein Roe & Farnham, managing a variety of accounts including a mutual fund. Single-State Investment Risk: A fund that. the President of the Stein-Roe fund complex, which managed the Growth Stock Fund at that Stock Fund and approximately 50 round trips in the Young Investor. Fund carefully before investing. To obtain the fund's most recent periodic reports and other regulatory filings, contact your financial advisor or download. Stein Roe Young Investor Fund (). As a winner, she gets more shares in the fund, which gives young people a taste of finance through kid. Stein Roe Mutual Funds established the Young Investor Fund to stimu late interest in investing at a young age, to educate both children and their parents on. fund or two, which you can easily afford with the $ Take a look at the previous question where I mentioned the Stein Roe Young Investor Fund. When you. family finances including ownership of any mutual funds or investments in the Stein Roe Young Investor. Fund offered by respondent. The survey states that. The popularity of stock-picking contests and high school investment clubs -- along with successful marketing vehicles, such as Stein Roe's Young Investors Fund. Callahan was a regional finalist for Ernst & Young's “Entrepreneur of the Year” award in the financial securities category. Stein Roe & Farnham; Senior Vice. Performance before March 31, , is of The Stein Roe Young Investor Fund (the Fund). The Fund's past performance has been linked to the Core Growth. special children's mutual funds: Stein Roe's 'Young Investor' and AIG's. 'Children's World' in the US; Invesco's 'Rupert the Bear' fund in Britain;. Cited.

1 2 3 4 5 6